Decentralizing Creativity: From Platform Rent to Digital Real Estate

The Creator Economy, valued at over $250 billion, is facing an existential crisis fueled by platform instability, opaque monetization, and the flood of “AI Slop” content. Web3—the vision for a decentralized, user-owned internet built on blockchain technology—is not just an optional upgrade; it is an essential architectural shift promising to redefine content ownership, audience relationships, and creator monetization by 2026.

This forecast analyzes the transformative impact of Web3, focusing on how Non-Fungible Tokens (NFTs) and Decentralized Autonomous Organizations (DAOs) move control and value away from central platforms (Web2) and back to the artists, musicians, writers, and developers who generate the content. We assess the market’s trajectory, identifying the hurdles of adoption and regulation that must be overcome for Web3 to achieve mainstream commercial viability.

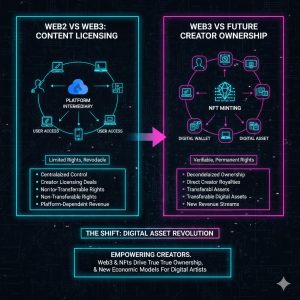

1. Content Ownership: NFTs and the Shift from Licensing to Asset

The most fundamental shift Web3 introduces is transforming content from a licensed asset stored on a centralized server into a verifiable, tradable, digital asset owned by the creator and, potentially, the consumer.

1.1 Verifiable Digital Scarcity via NFTs

NFTs provide a cryptographic proof of ownership, verifiable on a public blockchain ledger. This changes the creator’s role from a content supplier to a digital asset entrepreneur.

-

Monetization Mechanism: Creators can sell their work (art, music, videos, articles) as unique, tokenized assets. Crucially, smart contracts embedded within the NFT can programmatically ensure the creator earns a defined percentage royalty every time the asset is resold on the secondary market—creating a perpetual income stream that Web2 platforms cannot offer.

-

The Value Proposition: This model incentivizes quality over sheer volume. A creator can achieve higher revenue from a small, dedicated group of 500 fans buying a tokenized album than from 500,000 streams on an ad-revenue-split platform.

1.2 Data Sovereignty and Anti-Deplatforming

In Web2, creators risk being “shadowbanned” or de-platformed instantly, causing years of work and audience connection to vanish. Web3 offers data sovereignty. The content link, the audience identity, and the monetization logic exist independently on the blockchain, freeing creators from the arbitrary policy whims of corporate platforms.

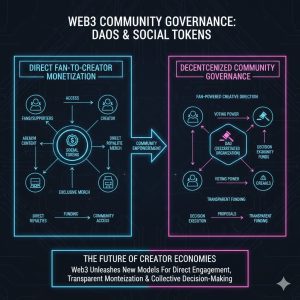

2. Creator Economy: DAOs, Tokenized Communities, and Direct Monetization

Web3 moves beyond transaction fees and advertising, enabling creators to build tokenized communities that turn passive fans into active, vested stakeholders.

2.1 The Rise of Community-as-a-Platform (DAOs)

Decentralized Autonomous Organizations (DAOs) allow creators to structure their community as a transparent, collective entity.

-

Governance and Funding: Creators can launch social tokens that grant supporters special access, governance rights, or even a share of future revenues. For example, a podcaster could use a DAO token to raise funds for production, allowing token holders to vote on episode topics or share in the ad revenue.

-

Token-Gated Access: Token-gating creates exclusive, highly engaged niche communities. Holding a specific NFT acts as a membership card, granting access to private Discord channels, exclusive events, or pre-release content, replacing traditional subscription models with a tradable, value-accumulating asset.

2.2 Direct Payout and Reduced Intermediary Fees

By leveraging cryptocurrencies and smart contracts, Web3 enables direct, instantaneous payments between the fan and the creator. This bypasses traditional payment processors and platforms that often take 20-50% cuts. The reduction in intermediary fees directly increases the creator’s take-home revenue, making smaller, niche audiences financially viable. This shift mirrors the complex challenges regulators face in categorizing and governing new digital asset classes. For context on the regulatory environment: The Regulation of Generative AI (US/EU): New Laws and Their Impact on Content Creation Platforms

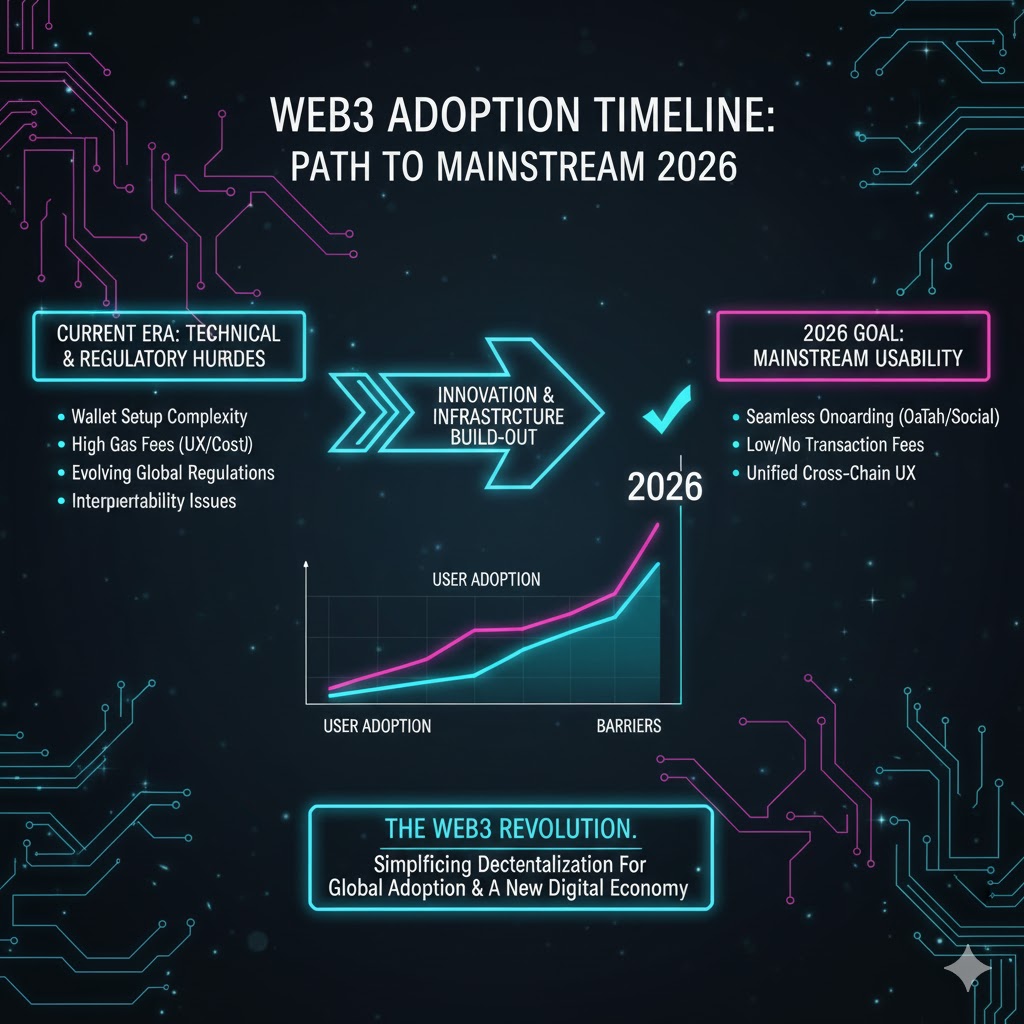

3. 2026 Forecast: Adoption Challenges and the Road to Mainstream

While the technological promise of Web3 is massive, the 2026 forecast remains cautious, balancing rapid innovation with significant technical and regulatory barriers.

3.1 Key Barriers to Mass Adoption

The biggest hurdles preventing creators and consumers from fully transitioning to Web3 are centered on usability and technical complexity:

-

User Experience (UX): Managing private keys, setting up crypto wallets (Metamask), and navigating multiple blockchain bridges remains confusing and “dangerous” for mainstream users. Simplified onboarding and unified interfaces are the key near-term focus (2025-2026).

-

Regulatory Uncertainty: The lack of definitive global guidance (especially in the US from the SEC/IRS) regarding the legal classification of NFTs and creator tokens (security vs. commodity) makes enterprises wary of large-scale adoption and complicates compliance.

-

Scalability: While Layer 2 solutions (e.g., Rollups) are rapidly improving, network fees (gas) and transaction speed still occasionally hinder the micro-transaction volume needed for a global creator economy.

3.2 The 2026 Prediction: Hybrid Adoption

By 2026, the market will largely operate in a Hybrid Web2.5 state.

-

Major platforms (YouTube, Spotify) will integrate token-gated features and NFT galleries to retain creators, but the underlying content delivery and core monetization will remain centralized.

-

Niche, high-value creators (e.g., luxury digital artists, specialized musicians) will fully migrate to Web3-native platforms, demonstrating the maximum financial benefits of true ownership. This cohort will prove that sustainable businesses can be built independently of corporate platform policies.

4. Final Verdict: Ownership Reshaping Value

Web3 is fundamentally restructuring the financial relationship in the creator economy. The movement from content rental to asset ownership via NFTs, and the democratization of community governance via DAOs, establishes a new model where the value captured by the creator is maximized. While technical and regulatory friction remains high, the economic incentives are too powerful to ignore, guaranteeing Web3’s continued strategic growth through 2026.

REALUSESCORE.COM Analysis Scores

| Evaluation Metric | Content Ownership (NFTs) | Creator Monetization (DAO/Tokens) | Mainstream Adoption (2026) |

| Value Transfer Effectiveness | 9.5 | 9.2 | 6.0 |

| Ease of Use/UX | 5.5 | 6.0 | 4.5 |

| Security (Transparency/Provable IP) | 9.0 | 9.0 | 8.0 |

| Platform Independence | 9.8 | 9.7 | 7.0 |

| REALUSESCORE.COM FINAL SCORE | 8.0 / 10 | 7.9 / 10 | 6.4 / 10 |