💡 The Angstrom Era The Foundry Triopoly at 2nm

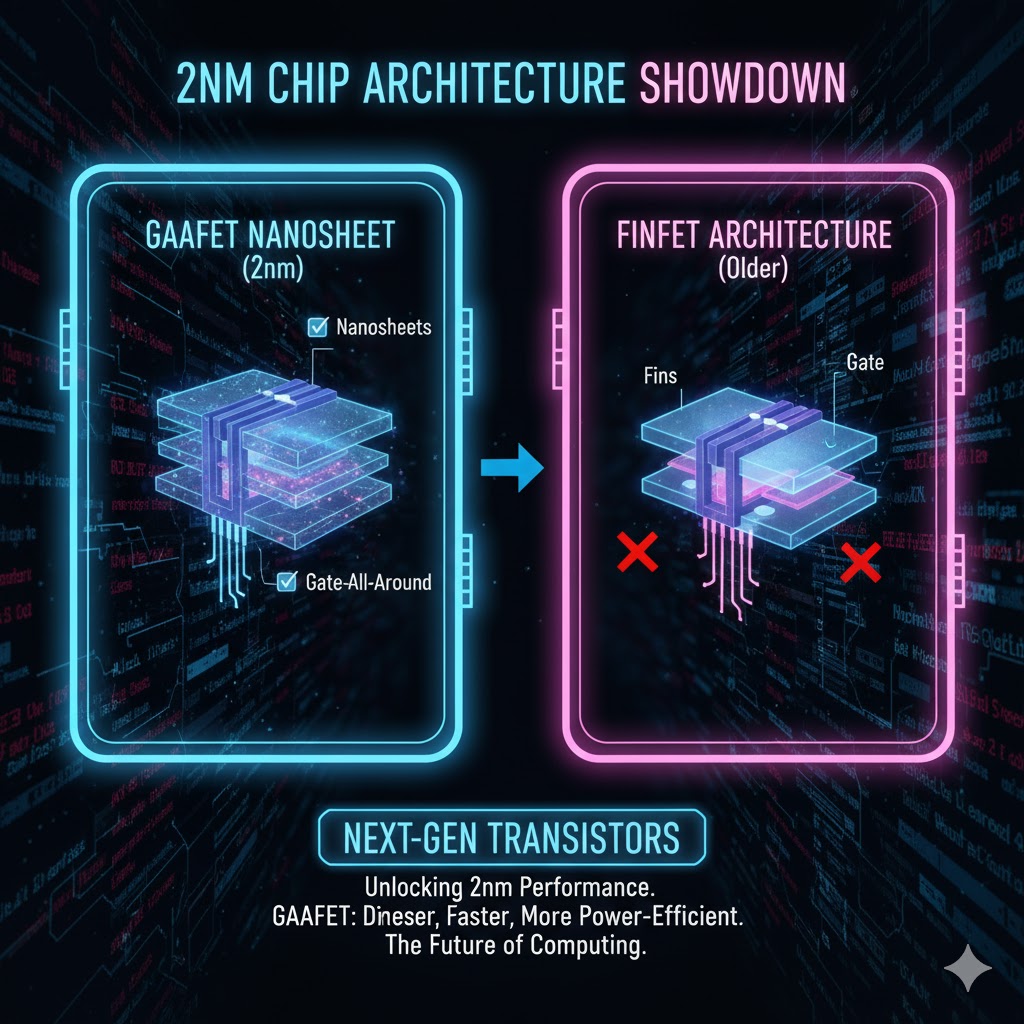

The year 2026 marks the beginning of the Angstrom Era in semiconductor manufacturing, a period where critical dimensions are measured in tenths of a nanometer. This technological inflection point is defined by the shift from the venerable FinFET (Fin Field-Effect Transistor) architecture to the revolutionary GAAFET (Gate-All-Around FET), which is essential for further power and performance gains.

At the heart of this revolution is a fierce competition for global foundry dominance involving the established leader TSMC, the persistent innovator Samsung Foundry (SF), and the determined contender Intel Foundry (IF). The 2nm node (or Intel’s equivalent 20A/18A) is not just a technology race; it is a geopolitical and economic battleground that will dictate the future of Artificial Intelligence, High Performance Computing (HPC), and mobile consumer electronics for the next decade.

This pillar guide analyzes the strategic roadmap of each major player, examining their technical choices, current yield challenges, and their projected market standing in the 2nm landscape.

1. The Technological Hurdle Gate All Around GAAFET

The key to unlocking the 2nm performance jump is the GAAFET structure. FinFET, which powered nodes from 22nm down to 3nm, has reached its physical limits in controlling leakage current.

The GAAFET Advantage

GAAFET technology wraps the gate material completely around the channel (often formed by stacked nanosheets or nanowires). This complete encirclement provides unparalleled electrostatic control over the flow of electrons, resulting in:

-

Significantly Reduced Leakage: Leading to better power efficiency (up to 25 percent power reduction at the same performance).

-

Enhanced Performance: Higher drive current at the same voltage (up to 15 percent performance increase).

-

Improved Scaling: The structure allows for denser transistor packing.

Samsung was the first to implement GAAFET (or MBCFET Multi-Bridge Channel FET) at the 3nm node. In 2026, both TSMC and Intel are deploying their versions of GAAFET at 2nm/18A, leveling the playing field on architectural fundamentals, but intensifying the manufacturing stability battle.

2. TSMC The Yield Leader and Ecosystem Builder (N2)

Taiwan Semiconductor Manufacturing Company (TSMC) maintains its position as the undisputed market share leader, primarily through stable execution and rapid capacity expansion.

TSMC’s N2 (2nm) Strategy

TSMC’s 2nm node (N2) features its first-generation nanosheet transistor (GAAFET) structure. The strategy is built on two core pillars:

-

Conservative Transition: TSMC is known for its meticulous, staggered approach. Their transition from 3nm FinFET to 2nm GAAFET is designed to minimize risk, leveraging their deep experience with Extreme Ultraviolet (EUV) lithography.

-

Advanced Packaging Dominance: TSMC’s true competitive moat lies not just in the logic node, but in its advanced packaging technologies like CoWoS (Chip-on-Wafer-on-Substrate) and SoIC (System-on-Integrated Chips). These packaging solutions allow chip designers (Apple, NVIDIA) to stitch together multiple smaller chips (chiplets) into a powerful system, offsetting minor delays or issues at the bleeding edge logic node.

Market Status (2026): TSMC is reportedly achieving stable yield rates (60 percent plus) on early 2nm production, securing nearly all major client orders (Apple, NVIDIA, AMD) for high-performance computing (HPC) and mobile chips scheduled for 2026 and 2027 adoption.

3. Samsung Foundry The Early GAA Bet (SF2)

Samsung Foundry (SF) aggressively adopted the GAAFET structure at the 3nm node (SF3), giving them a technical head start in mastering the new architecture.

Samsung’s SF2 (2nm) Strategy

Samsung’s 2nm process (SF2) is focused on optimizing the GAAFET experience gained at 3nm.

-

Performance and Power Efficiency: SF2 promises significant improvements over SF3, with estimates suggesting 12 percent better performance and 25 percent greater power efficiency. This level of scaling is essential to attract major North American clients.

-

The Yield Hurdle: SF’s primary challenge remains manufacturing stability and yield rates. While the company aims for ambitious 70 percent yield targets for 2nm by early 2026, initial reports often indicate a yield gap compared to TSMC.

-

Integrated Ecosystem: Samsung leverages its unique position as an Integrated Device Manufacturer (IDM) that produces both logic chips (foundry) and memory (HBM, LPDDR). This one-stop shop capability is a massive advantage for complex AI chip designs that require high-bandwidth memory (HBM) integration.

4. Intel Foundry The Aggressive Comeback (18A)

Intel Foundry (IF) is executing an unprecedented “four nodes in five years” strategy to reclaim process leadership, focusing its efforts entirely on the 1.8nm equivalent node.

Intel’s 20A and 18A Strategy

Intel defined its 2nm equivalent as 20A (Angstrom), featuring two crucial innovations:

-

RibbonFET: Intel’s proprietary name for its GAAFET structure.

-

PowerVia: A revolutionary backside power delivery network (BSPDN) that moves power routing wires to the back of the wafer. This innovation drastically cleans up the front side wiring, allowing for much denser transistor logic and improved signal integrity.

The Strategic Skip: Intel strategically canceled the widespread production of the 20A node to funnel all resources and learnings directly into the more advanced 18A (1.8nm) node. This move aims to leapfrog TSMC and Samsung by productizing a process that includes both GAAFET (RibbonFET) and PowerVia for external foundry customers, with production slated for late 2025/early 2026. This aggressive maneuver turns the battle from a two-way race into a triopoly.

Intel’s success is intrinsically tied to its ability to attract external foundry customers, a feat that requires proving high and stable yields on this groundbreaking technology. Building market trust, especially in highly competitive technical fields, is paramount. For insights into securing a competitive edge beyond technology alone, explore our guide on autonomous digital workers framework comparison where platform adoption strategies are discussed.

5. Geopolitical and Market Implications

The battle at the 2nm node is shaped by factors extending far beyond the cleanroom.

Capacity Wars and AI Demand

The explosive growth of Artificial Intelligence is driving unprecedented demand for the most advanced nodes. TSMC is racing to meet this demand, while Samsung and Intel are using their new nodes as leverage to secure crucial AI contracts. The capacity struggle means pricing remains extremely high for 2nm wafers, benefiting the foundries but creating supply chain pressure for chip designers.

The Role of High-NA EUV

The next step beyond 2nm (e.g., 1.4nm/14A) will require the adoption of High-NA (High Numerical Aperture) EUV lithography, a technology so complex and expensive that it further restricts the field of major players. Intel has aggressively invested in these machines, signaling its long term commitment to leadership.

Geopolitical Risk

TSMC’s concentration of manufacturing in Taiwan presents a significant geopolitical risk, pushing major clients and governments (US, Japan, EU) to heavily subsidize and encourage the diversification of foundry capacity to the US (Arizona) and Korea. This trend benefits both Samsung and Intel’s foundry expansion plans.

✅ Conclusion The New Triopoly

The Global Semiconductor Foundry Landscape in 2026 is no longer a duopoly but a nascent triopoly defined by the crucial GAAFET transition:

-

TSMC (N2): The current leader, relying on yield stability, capacity, and packaging innovation. It holds the lead in client trust and market share.

-

Samsung (SF2): The aggressive technical innovator, leveraging its early GAA experience and IDM ecosystem to compete on performance and integrated solutions.

-

Intel (18A): The aggressive challenger, betting on revolutionary architectures like PowerVia to leapfrog the competition and reclaim process leadership by 2026.

The ultimate winner of the 2nm race will be the foundry that can first demonstrate high, stable yields on the complex GAAFET architecture, unlocking the next wave of high-performance and energy-efficient computing for the world.