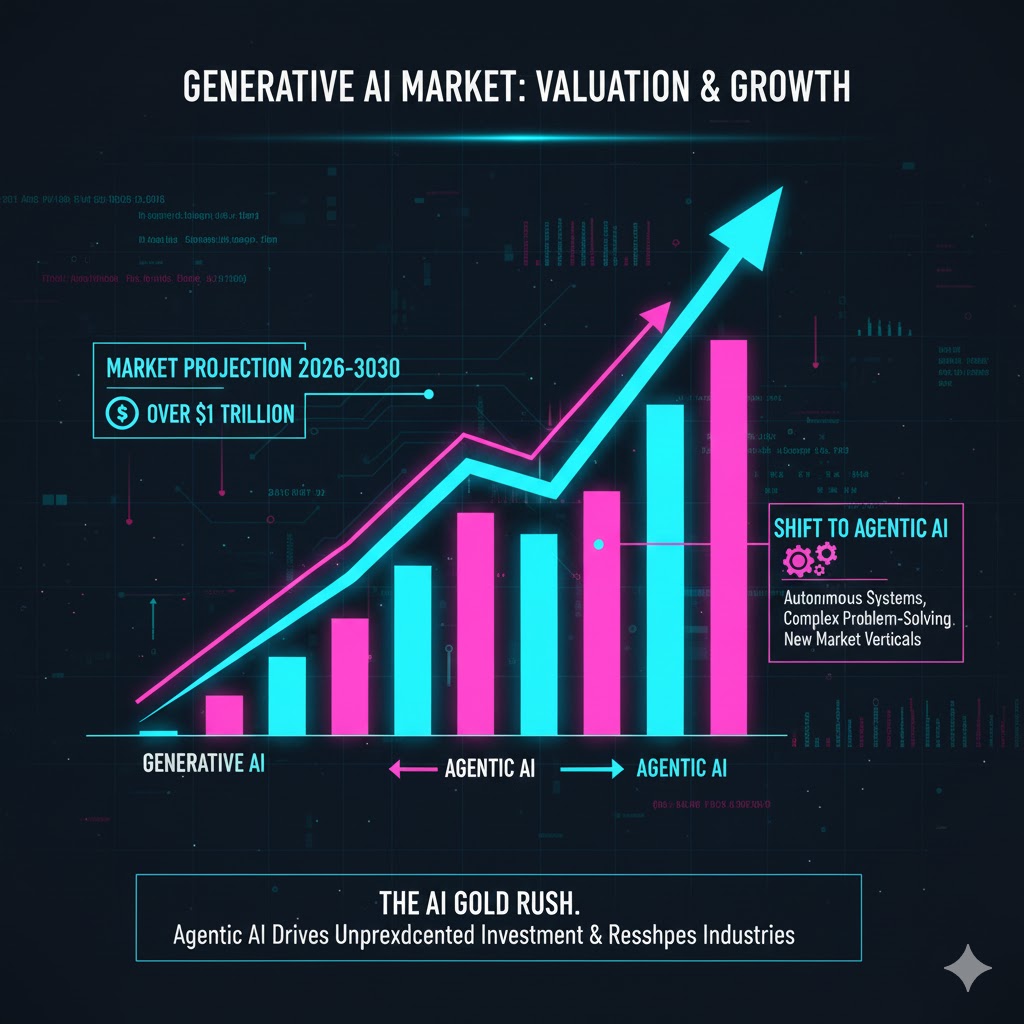

The $1 Trillion Transformation: Generative AI as the New Utility

For the astute investor and forward-thinking professional, Generative AI (Gen AI) is no longer an emerging technology; it is the fundamental infrastructure of the modern digital economy.1 By 2026, the global Generative AI market is rapidly shifting from a theoretical concept to a multi-hundred-billion-dollar enterprise.2 Estimates place the market size, which was roughly $71.36 billion in 2025, on a trajectory to potentially exceed $500 billion by 2030, growing at a remarkable CAGR of over 40% 1.2, 4.4. This is not simply a boom; it’s an investment cycle on par with the rise of electricity and computing, with investment levels expected to approach 2% to 5% of global GDP 1.1.

This profound, market-reshaping technology is driving unprecedented capital expenditure (capex), with major U.S. tech companies tripling their annual spending since 2023. The surge in investment into cloud GPUs and data center capacity signals a clear, long-term commitment to scaling the Gen AI revolution.

1. Market Valuation and The Infrastructure Arms Race

The valuation of the Generative AI Market is being driven by two distinct, highly capitalized layers: the foundational infrastructure and the specialized software layer.

The Trillion-Dollar Infrastructure Bet

The immediate investment focus is on the hardware that powers the models. Companies are locked in an “arms race” to acquire and deploy Graphics Processing Units (GPUs) and build massive data centers. Key trends include:

-

Massive Capex: Capital investment in AI-related infrastructure contributed significantly to U.S. GDP growth in 2025 and is set to continue through 2026 1.1. Some estimates project a cumulative investment of over $1 trillion in data center capacity over the next several years 1.1.

-

Cloud GPU Dominance: The increasing deployment of powerful cloud GPUs is democratizing Gen AI development, enabling lean startups to fine-tune large models without owning the physical infrastructure 1.2.3

-

The Next Frontier: Agentic AI: The next major valuation inflection point is the shift from current Large Language Models (LLMs) to Agentic AI—systems capable of reasoning, planning, and performing complex, multi-step tasks autonomously, with some predicting human-level performance by mid-2026 1.1, 3.4.4 This capability will unlock enormous value in enterprise automation.5

Investment Trends: From General Models to Vertical SaaS

The most explosive growth is expected in the Software-as-a-Service (SaaS) segment, driven by enterprise demand for embedded intelligence 1.2.

-

Vertical AI Specialization: The focus is moving beyond generic foundation models toward highly specialized, domain-specific AI solutions 1.2, 3.4.6 Examples include:

-

Healthcare: Accelerating drug discovery, clinical trials, and personalized medicine 1.2, 3.4.7

-

Finance (BFSI): Enhancing fraud detection, risk modeling, and regulatory compliance 3.4.8

-

Legal/Manufacturing: Creating domain-focused copilots and optimized logistics systems 1.2.9

-

-

Embedded Intelligence: Gen AI is moving directly into existing enterprise workflows—CRMs, ERPs, and internal tools—to enhance workflow efficiency and ensure compliance 1.2, 3.2.10

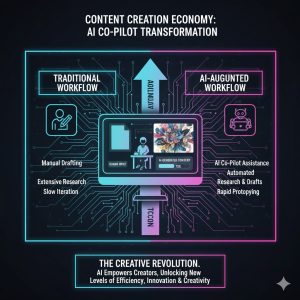

2. The Content Creation Economy: Productivity and Personalization

Generative AI is not simply changing the tools of content creation; it is fundamentally altering the economics of the entire creator industry.11

The Democratization and Acceleration of Production

AI is leveling the playing field for content creators.12

-

Increased Productivity: Content marketers using AI tools report productivity increases of up to 67% 2.2.13 This acceleration allows creators to maintain consistent publishing schedules—a critical factor for subscription retention 2.2.

-

Quality Floor Rises: AI tools for writing, image generation, and video editing enable solo creators and small businesses to produce content at a quality and quantity previously reserved for large enterprises 2.4.14

-

Video Going Mainstream: Generative Video technology is poised to come of age in 2026, slashing production time and costs for high-quality animation and special effects, impacting the film, TV, and advertising sectors 2.1, 3.1.15

New Monetization and The Hybrid Human-AI Model

The most successful new business models blend human creativity with Gen AI efficiency.16

-

Hyper-Personalization: AI excels at creating content variations tailored to different audience segments, delivering a significantly higher Return on Investment (ROI) on marketing spend 2.2.17

-

New Revenue Streams: The content economy is seeing the rise of subscription-based AI services, customized niche platforms, and marketplaces connecting businesses with AI-empowered creators 2.2.18

-

The Human Edge: The value of content is shifting away from mechanical production and toward unique human insights, authentic voice, and creative strategy—elements AI cannot replicate 2.4.19 The most profitable model is the hybrid one: using AI for drafting and scaling, and humans for governance, originality, and brand voice 2.3.20

3. Final Verdict: The Strategic Imperative for 2026

The Generative AI Market is past the initial hype cycle and is now in a hyper-growth phase focused on deployment, verticalization, and generating tangible business value. The market is projected to continue its exponential rise, driven by the massive infrastructure investment and the clear productivity gains across every sector.

For the investor, the strategic imperative is to look beyond the general LLMs and focus on the vertical AI solutions and the agentic systems that will automate complex enterprise workflows.21 For the professional, the imperative is adaptation: adopting AI copilots to enhance individual productivity and focusing skillsets on creative oversight, data governance, and strategic application.

The risk of an investment bubble exists, but the transformative nature of this technology—the ability to drive the cost of expertise toward zero and fundamentally reshape the content creation economy—suggests that the massive growth, especially in specialized SaaS and infrastructure, is just beginning.

The following scores reflect our analysis of the current market landscape and its potential for long-term value.

REALUSESCORE.COM Analysis Scores

| Evaluation Metric | Score (Out of 10.0) | Note/Rationale |

| Market Valuation & Growth Trajectory | 9.7 | CAGR >40% with strong enterprise adoption; trajectory to $500B+ by 2030. |

| Investment Concentration (Infrastructure) | 9.9 | Unprecedented capex in GPUs and data centers signals long-term commitment. |

| Value of Vertical AI Solutions | 9.5 | High ROI expected from specialized models (Healthcare, Finance) over general LLMs. |

| Impact on Content Creation Economy | 9.6 | Massive democratization and acceleration of content creation and personalization. |

| Future Proofing (Agentic AI) | 9.8 | The shift to autonomous, reasoning Agentic AI will unlock the next wave of value. |

| REALUSESCORE.COM FINAL SCORE | 9.7 / 10 | A fundamental, irreversible technological transformation with sustained, multi-layered growth potential. |