1. What is the Digital Markets Act (DMA)? The End of Tech Monopolies

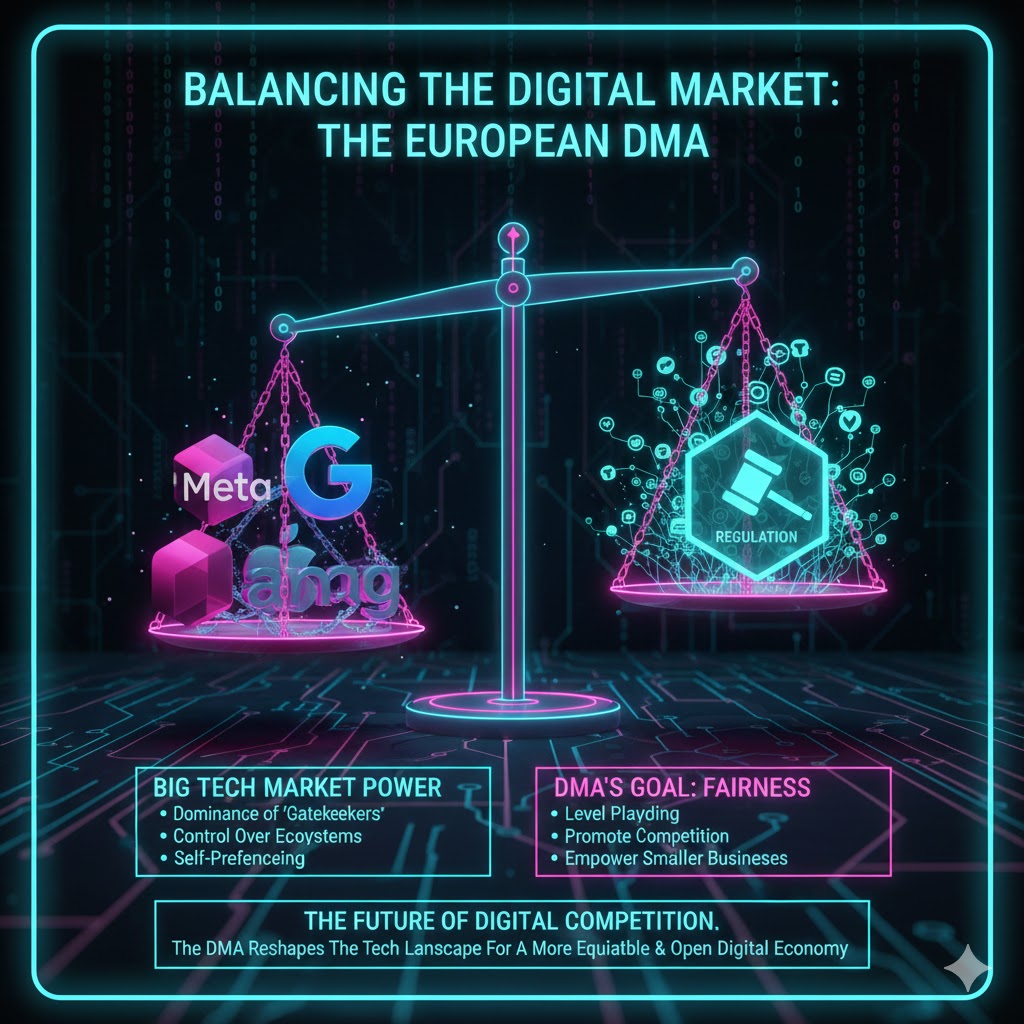

The European Union’s Digital Markets Act (DMA) is arguably the most significant piece of digital regulation introduced globally in decades. Simply put, the DMA is a new set of rules designed to make the digital economy fairer and more competitive for everyone—from small startups to everyday consumers.

For years, a handful of giant technology companies—often called Big Tech—have controlled the essential parts of the digital world, such as app stores, search engines, and messaging services. This control created a situation where smaller competitors struggled to get noticed, and consumers often had no real choice. The DMA is Europe’s answer to this power imbalance.

The core goal of the DMA is not to punish these companies, but to force them to open their doors to competition. It aims to prevent them from using their dominant position to unfairly benefit their own services over those of rivals. For example, the law seeks to stop a company that owns an app store from making its own streaming service easier to find than a competitor’s.

1.1 Identifying the “Gatekeepers”

The DMA doesn’t apply to every tech company; it targets those so large and powerful they act as “gatekeepers” to the market. A company is designated a Gatekeeper if it meets certain criteria, focusing on size, market control, and influence over millions of European users.

These Gatekeepers—a list that includes major players like Apple, Google (Alphabet), Meta, Amazon, and Microsoft—must comply with a strict list of dos and don’ts. The penalties for breaking these rules are severe, potentially costing them billions of dollars in fines (up to 10% of their global annual revenue). This high-stakes environment is why the DMA creates a major Market Share Change Risk for these giants.

2. The Great Unbundling: Key Rules Driving Market Change

The DMA is a detailed piece of legislation, but its core impact can be broken down into a few critical rules that directly threaten the established monopolies of the Gatekeepers. These rules are designed to break apart the tightly knit ecosystems that have kept competitors out.

2.1 Rule 1: Stopping Self-Preferencing and Bundling

The most immediate change is the prohibition of “self-preferencing.” Gatekeepers can no longer use their dominance in one area (like an operating system) to unfairly push their services in another area (like an app).

-

Example: Google Search cannot place its own services (like Google Flights or Google Maps) at the very top of the results page without offering similar visibility to competitors like Skyscanner or other local map providers.

-

Impact: This rule immediately forces rival services, which were previously buried, onto the same playing field, giving them a real chance to gain new users.

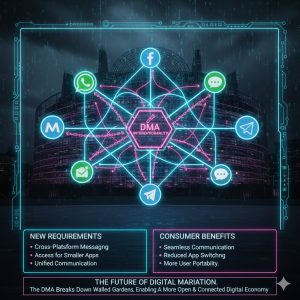

2.2 Rule 2: Interoperability for Messaging Services

This is a game-changer for how we communicate. The DMA requires the biggest messaging services (like WhatsApp and Meta’s Messenger) to become interoperable with smaller rival platforms.

-

What it means: Users on a small messaging platform must be able to send texts, images, and eventually make voice/video calls directly to users on the large Gatekeeper platforms, without having to switch apps.

-

Impact: This destroys the “network effect” that keeps users locked into the largest apps. People no longer need to use WhatsApp just because all their friends use it. This opens the door for new, privacy-focused, or feature-rich apps to compete effectively.

2.3 Rule 3: Opening Up App Stores and Operating Systems

For years, companies like Apple and Google maintained complete control over their device ecosystems. The DMA forces them to open up their platforms significantly.

-

Alternative App Stores: Users must be allowed to download apps from stores other than the Gatekeepers’ official stores (sideloading and third-party stores). This is the biggest change, as it bypasses the fees (the “Apple Tax” or “Google Tax”) that have been a massive source of revenue.

-

Data Portability: Users must be able to download all their data (photos, contacts, conversations) and move it easily to a competitor’s platform. This lowers the barrier for consumers who want to switch services.

-

Removing Default Apps: Gatekeepers cannot force users to keep default applications. Users must be easily able to change their default web browser, voice assistant, or search engine.

This set of rules is the primary engine for the Market Share Change Risk, as it directly attacks the Gatekeepers’ most profitable and tightly controlled areas.

3. The Market Share Change Risk Score (MSCRS) Framework

To understand the potential damage or opportunity created by the DMA, we introduce the Market Share Change Risk Score (MSCRS). This score is not a measurement of legal compliance; rather, it is an analysis of how vulnerable a Gatekeeper’s dominant position is to the new competitive pressure introduced by the DMA.

The MSCRS framework evaluates three key factors that determine how much market share a Gatekeeper might lose or gain:

| Factor | Description | High Risk = High MSCRS |

| Monopoly Dependency (MD) | How much does the Gatekeeper rely on its existing monopoly position (e.g., forcing users to use its own app store) for revenue? | High reliance on fees, bundled services, or default settings. |

| Ecosystem Friction (EF) | How difficult will it be for the Gatekeeper to technically change its product to comply with the rules (e.g., building secure interoperability)? | High technical complexity and deep integration of their services. |

| Consumer Switching Incentive (CSI) | How strongly do users want to switch away once the rules are relaxed? (e.g., switching from a default app to a better competitor.) | Users are actively looking for better alternatives in price, privacy, or features. |

A high MSCRS indicates that the Gatekeeper’s market share in a specific service category is highly unstable and likely to decline as new rivals enter the market.

3.1 Sector Analysis: Where is the MSCRS Highest?

The risk is not uniform. Different sectors face different levels of competitive threat:

-

App Stores (Extremely High Risk): The ability for third-party app stores to exist bypasses the 15-30% transaction fees collected by Apple and Google. Since these fees represent billions in high-margin revenue, and developers have a massive financial incentive to switch, this sector faces the highest MSCRS. The market share of the official stores is highly likely to shrink as developers and users seek better deals elsewhere.

-

Messaging (High Risk): The interoperability rule directly attacks the “network effect.” This effect is the single biggest barrier for rivals. Once that barrier is removed, users are free to try smaller apps without penalty, leading to a slow but steady fragmentation of the messaging market share.

-

Web Browsing/Search (Moderate Risk): The requirement to offer a choice screen for the default browser and search engine is a major change. However, established habits and brand loyalty are strong here, so while market share will shift toward rivals like DuckDuckGo or Firefox, the overall risk is lower than the App Store crisis.

4. Strategic Responses and The Future of Big Tech in Europe

The DMA is not just a regulatory hurdle; it’s a massive strategic challenge for the Gatekeepers. Their responses will define the future of the European digital landscape.

4.1 Gatekeeper Tactics: Compliance vs. Control

Companies are generally responding in two ways:

-

“Just Enough” Compliance: Many Gatekeepers are implementing changes in the narrowest possible way to maintain control. For instance, creating complex technical requirements for third-party app stores or making the user experience for choosing an alternative browser clunky. This is an attempt to legally comply while minimizing the practical impact on their market share.

-

Focusing on Services Outside the DMA: Gatekeepers are rapidly investing in new service categories (like hardware, cloud computing services, or subscription bundles) that are currently outside the DMA’s strict scope, preparing for a future where their current core services are less profitable in Europe.

4.2 The Opportunity for Small and Medium Enterprises (SMEs)

The DMA represents a golden age of opportunity for smaller tech companies. They now have access to users without having to go through the bottleneck of the Gatekeepers’ platforms.

-

Financial Incentive: Developers can now launch their apps through alternative channels, keeping a much larger share of the revenue, which fuels innovation.

-

Level Playing Field: For the first time, small search engines, map services, and messaging apps will be presented directly to consumers as equal alternatives, allowing them to compete purely on product quality and features.

The DMA’s ultimate success will be measured by whether it truly increases the market share of these smaller players and fosters real competition. For consumers, the outcome should be more choices, better privacy, and lower prices across digital services.

5. REALUSESCORE.COM Analysis: Market Share Change Risk Score

This table evaluates the Market Share Change Risk Score (MSCRS) for various Gatekeeper services, focusing on how vulnerable their dominant position is under the new DMA rules.

| Gatekeeper Service Category | MSCRS (Out of 10) | Primary DMA Rule Impact | Market Share Outlook |

| Mobile App Stores | 9.5 | Allowing third-party stores; bypassing fees. | High Loss. Developers have a massive financial incentive to shift distribution, leading to a quick decline in Gatekeeper store share. |

| Default Messaging | 8.8 | Mandatory interoperability with smaller apps. | Gradual Loss. The “network effect” is broken, allowing users to slowly migrate to competing platforms based on features/privacy. |

| Search Engine Defaults | 7.0 | Mandatory choice screens for default search and browser. | Moderate Loss. Choice screens will introduce rivals, but user habit and brand familiarity will slow the change. |

| Web Browser Defaults | 7.5 | Mandatory choice screens and access to browser engines. | Moderate Loss. Stronger competition for mobile browsing share as users are forced to choose. |

| Operating System Control | 6.0 | Opening access to hardware and non-Gatekeeper apps. | Low Risk. While open, the underlying OS remains complex; the change is indirect, mostly impacting App Store fees. |