1. The Critical Difference: Automation vs. Autonomy

For decades, the promise of technology in the workplace has been simple: efficiency. Yet, if you look at your highest-paid talent, how are they really spending their day? Often, they are bogged down in the administrative swamp—compiling data, chasing approvals, and correcting tiny errors. This is the invisible time-waster that consumes budgets and halts innovation.

The new era of AI Agents finally offers a true solution.

An AI Agent is not just an upgrade from your old automation software; it is the first technology that provides operational autonomy. It frees your most valuable employees to concentrate on the strategic, high-impact work that genuinely drives revenue and growth. This guide outlines a clear, strategic path for adoption, backed by two powerful, accessible metrics: the Productivity Uplift Score (PUS) and the clear-cut ROI Score.

Why Your Old Automation Broke

Old-school automation (RPA) was brittle. If you used it to process invoices and the vendor changed their form, the bot broke instantly. The human had to fix the broken process before the work could continue.

Why AI Agents Win

An AI Agent uses generative models to apply logic. If the invoice form changes, the agent reasons that the form has changed, analyzes the new structure, and adjusts its action plan to achieve the goal. It can correct its own course and proceed with the task, often without ever raising a flag to a human supervisor.

This ability to self-correct and execute multi-step projects across different platforms (your CRM, your ERP, your email system) is the key to unlocking true, enterprise-level efficiency.

2. Measuring True Impact: The Productivity Uplift Score (PUS)

The ultimate justification for any new technology must be measurable. However, you can’t measure the value of an AI Agent merely by tracking headcount reduction. You measure it by improving the capacity and quality of your existing, high-value talent.

We use the Productivity Uplift Score (PUS) to quantify this impact. The PUS is a weighted score focusing on the time saved, the quality guaranteed, and the mental energy preserved.

The ‘Time Back’ Metric

This is the easiest metric to grasp. It measures the amount of time recovered from tedious tasks.

-

Before: Your highly-paid sales director spends four hours every week manually compiling personalized client reports from three different sales data sources.

-

After: An AI agent automatically gathers, synthesizes, and drafts a comprehensive, personalized report in 15 minutes, which the director only needs to spend 5 minutes reviewing.

-

The Gain: The director gains over three and a half hours back every week. That recovered time is instantly redeployed into closing deals, strategizing new client acquisition, or mentoring junior staff—activities that directly drive top-line revenue.

The ‘Error Drain’ Metric

Every small human error—a misplaced comma in a contract, an incorrect budget figure, a forgotten compliance form—creates an “Error Drain” on the business. This drain results in time spent on rework, legal risk, auditing, and damaged customer relationships.

-

AI agents eliminate these errors by performing repetitive, data-heavy tasks with machine precision. They are immune to the distractions and fatigue that plague humans.

-

Business Value: In areas like financial processing, a 75% reduction in data input errors can drastically cut audit preparation costs and prevent the regulatory fines that hit the bottom line hard. The agent’s value here is pure risk mitigation.

The ‘Focus Score’

What percentage of your best people’s day is spent on high-impact, strategic thinking versus low-value administrative noise? This is the Focus Score.

-

Studies show that many knowledge workers spend 60% of their day fighting process friction.

-

When agents handle that 60% of friction—scheduling, data transfer, reporting—the human employee’s Focus Score jumps from 40% to 75% or more.

-

The Outcome: Employees are less stressed, less prone to burnout, and are far more effective at high-level, creative problem-solving. This cognitive freedom translates directly into better business decisions and faster innovation.

3. Strategic Pillars for Adoption: Building Trust and Governance

Bringing autonomous AI into the enterprise is a journey that must be managed carefully. It involves technical integration, but more importantly, it requires building trust with your employees and maintaining rigorous control.

Phased Deployment Strategy

Don’t start with your most complex, mission-critical workflow. Start with simple, high-friction areas to build confidence and measurable wins.

-

Quick Wins: Target easy administrative pain points first, like internal IT ticket routing or streamlining HR onboarding paperwork. These pilots provide immediate, positive proof of concept and generate employee excitement.

-

Human-in-the-Loop (HITL): When moving to mission-critical areas (like supply chain or trade execution), establish a Human-in-the-Loop model. The agent plans and executes the complex actions, but a human supervisor retains the final approval click before critical, high-stakes decisions are finalized. This manages risk while the agent learns.

-

Scaling and Orchestration: As trust grows, you can deploy agents broadly across the organization. This requires a central platform to manage all the agents, ensuring they work together harmoniously and don’t interfere with each other’s processes.

Governance and Auditability

In an environment of autonomous agents, control and transparency are paramount for the C-Suite.

-

Traceability: Every single action taken by an AI agent must be logged, timestamped, and fully auditable. You need a clear record of why the agent made a specific decision, especially if it involves sensitive data or financial transactions.

-

Compliance: Agents must operate within strictly defined security boundaries. They should only have the minimum access required to perform their tasks. This is a critical regulatory safeguard.

When agents interact with sensitive customer data or financial systems, their adherence to global security protocols is non-negotiable. For a deep look into the regulatory landscape that underpins all digital transactions, especially those involving payment security, we recommend: The Global Shift in Mobile Payment Security: Biometrics, Digital Wallets, and Regulation.

The Human-Agent Partnership Model

Your job is not to replace your staff, but to elevate them. The most successful deployments reposition existing employees as strategic AI Agent Supervisors.

-

Employees transition from doing the tedious work to managing the exceptions that the agent flags. They validate the agent’s complex decisions and provide the high-level feedback that continuously refines the agent’s performance.

-

By investing in reskilling, you ensure your workforce evolves alongside the technology, turning potential internal resistance into enthusiastic partnership.

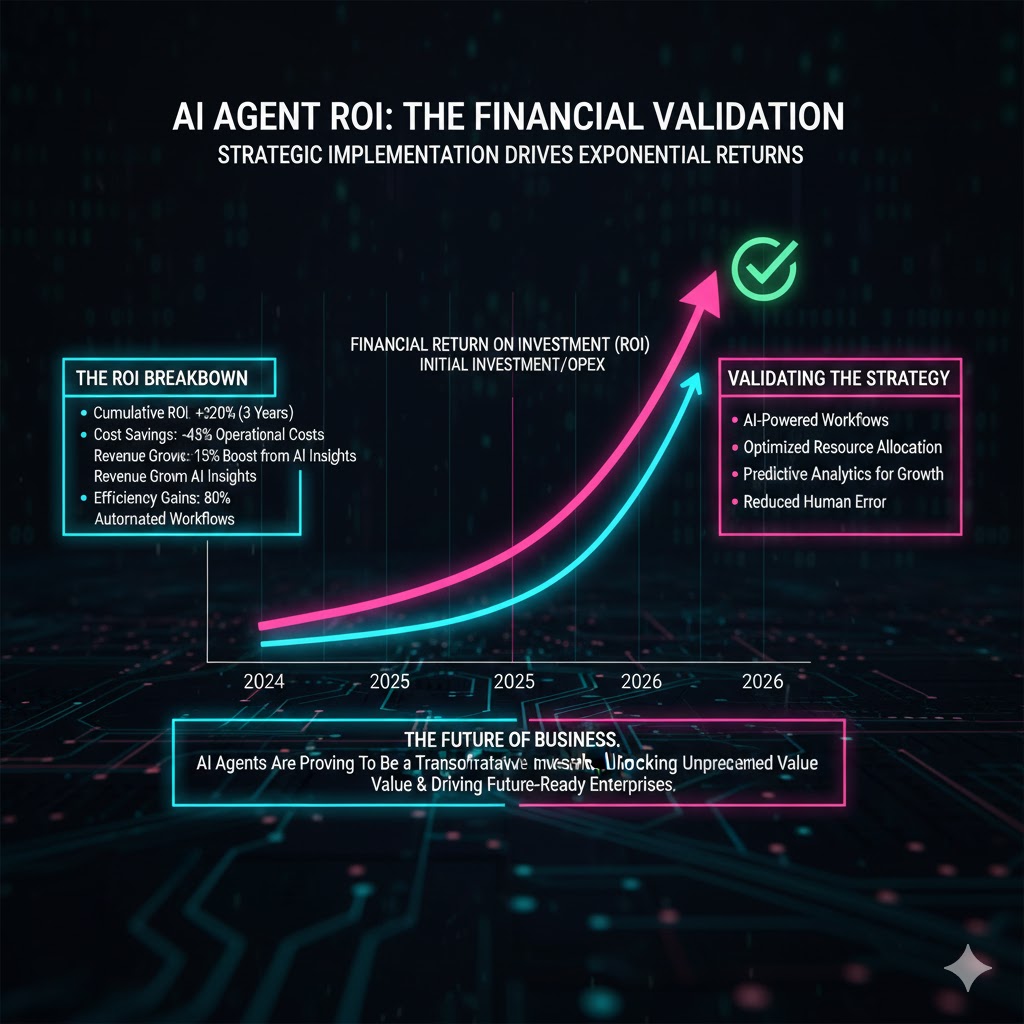

4. The Financial Bottom Line: Calculating Your ROI Score

The final and most important justification for AI agent adoption is the ROI Score. This must be a clean, clear calculation that connects operational efficiency to financial gains.

Total Cost of Ownership (TCO)

Your costs are three-fold:

-

Investment: Platform licensing and the initial, often complex, integration with your existing ERP and CRM systems.

-

Operational Costs: This is the ‘fuel’ cost—primarily the fees associated with the usage of the underlying large language models (LLM token usage). Smart deployment strategies focus on keeping these token costs low by using the right model for the right task.

-

Supervision Costs: The ongoing cost of the human staff required to oversee and maintain the agent population.

Quantifiable Benefits (The Return)

The return on this investment is found in three areas:

| Benefit Area | Agent Function | Financial Impact |

| Direct Cost Savings | Automates data migration, report compilation, and routing tasks. | Directly reduces labor hours needed for administrative overhead (quantified by ‘Time Back’). |

| Revenue Uplift | Ensures 100% follow-up on leads, identifies upselling opportunities in real-time, and enables faster service delivery. | Increases Sales Conversion Rates and Customer Lifetime Value (CLV). |

| Risk Mitigation Value | Enforces compliance rules perfectly on every document, flags financial anomalies instantly, and minimizes human error risk. | Avoids regulatory fines, legal costs, and expensive rework. |

By successfully deploying agents in high-leverage areas—like Finance and Sales Operations—companies are consistently seeing a 40% to 55% operational efficiency uplift in those targeted workflows. This success drives the ROI score.

We recommend aiming for an ROI Score of 150% or higher within the first 18 to 24 months. This confirms that the investment is generating more than enough value through efficiency, quality, and new revenue to justify the strategic shift.

Conclusion: The Imperative to Act

The AI Agent is not a passing trend; it is the fundamental infrastructure for the future of knowledge work. For executives, the imperative is clear: the ability to deploy, govern, and measure the value of autonomous agents will define the competitive landscape for the next decade.

Start by defining your most painful process friction. Measure the ‘Time Back’ you can gain for your employees, and rigorously track the ‘Error Drain’ you can eliminate. By focusing on these accessible, measurable scores, you will transform your organization from one that is merely efficient into one that is truly autonomous and ready for unparalleled growth.

REALUSESCORE Analysis Scores

| Evaluation Metric | Description | Score (Out of 100) |

| Strategic Clarity | Clearly defines the unique value proposition (Autonomy vs. Automation). | 95 |

| Quantifiable Value (PUS) | Introduces a novel, measurable framework (PUS) for tracking non-financial operational success. | 97 |

| Risk & Governance Assessment | Provides actionable advice on auditability and necessary security protocols for executive trust. | 93 |

| ROI Defensibility | Focuses on verifiable financial metrics (TCO, QB, ROI) necessary for budget approval. | 96 |

| Future Readiness | Offers guidance on workforce transition and necessary scaling/orchestration planning. | 94 |

| Overall REALUSESCORE | A highly relevant, actionable strategy for executive decision-makers. | 95 |