1. The End of Unlimited Growth and the Profitability Imperative

The streaming video industry, once defined by breakneck subscriber growth and “growth at any cost,” has entered a new phase characterized by the necessity for profitability. With global Subscription Video On Demand (SVOD) growth plateauing in mature markets, major players like Netflix, Disney+, and Warner Bros. Discovery (Max) are shifting their focus from subscriber volume to maximizing revenue per user (ARPU) and reducing content costs. This pivot is driving two major, interconnected trends: the intensification of the Exclusive Content War and the widespread adoption of Ad-Tier Models.

The market is currently oversaturated with over 200 streaming platforms, a number the industry cannot sustain long-term. This competitive pressure, combined with rising content spending (collectively surpassing $125 billion by major players), is forcing consolidation and the abandonment of the simple, single-tier subscription model.

2. The Content Wars: Consolidation and Anchoring Subscribers

Exclusive Content remains the single greatest driver for acquiring and retaining subscribers. However, the strategy is evolving from simply spending the most to spending smarter.

A. The Scarcity of Must-See Exclusives

To justify rising prices and combat high churn rates, platforms are increasingly relying on exclusive “anchor content”—must-watch originals, live sports, and prestige libraries—that lock users into the ecosystem.

-

Live Sports as the Anchor: Live sports, which create unique “appointment viewing,” have become a crucial battleground, commanding high carriage fees and attracting advertisers. Platforms are leveraging sports to anchor users and drive premium ad revenue.

-

The Content Shuffle: The cost of original programming has led to companies rethinking licensing. We are seeing major studios, who previously licensed content widely, pull their libraries back to their own platforms, or strategically sell licensed titles to competitors to fund new originals, creating a perpetual state of flux for consumers.

B. The Rise of Bundling and Aggregation

Consumer fatigue from juggling multiple subscriptions (“Subscription Fatigue”) and the escalating total cost of ownership are leading to a resurgence of the cable-like bundling model.

-

Internal Bundles: Companies are leveraging their own portfolios (e.g., Disney combining Disney+, Hulu, and ESPN+).

-

External Aggregation: Third-party aggregators (like Amazon Prime Channels, Apple, and telcos) are positioning themselves as unified hubs, offering consumers single-bill simplicity and unified search capabilities—replicating the convenience that streaming originally sought to replace. This trend toward integrated services and platforms is mirrored in other consumer technology fields.

3. The Revenue Revolution: The Rise of Ad-Tier Models (AVOD/FAST)

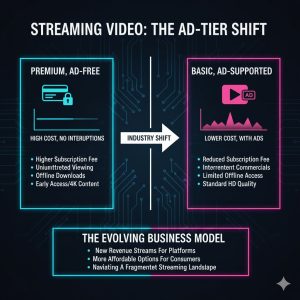

To achieve profitability while catering to price-sensitive consumers, nearly every major SVOD player has adopted a Hybrid Monetization Model that includes an ad-supported tier.

A. The Hybrid Model Dominance

The ad-supported Video On Demand (AVOD) and Free Ad-Supported Streaming TV (FAST) markets are experiencing massive growth, projected to surpass $40 billion in revenue in the coming years.

-

Shifting User Behavior: Consumers, facing rising living costs, are showing increasing willingness to accept ads in exchange for lower monthly fees. Services like Hulu and Peacock already see the majority of new subscribers opt for the ad-supported tiers. Even Netflix and Amazon Prime Video, once strictly ad-free, are prioritizing ad-tier adoption through strategic pricing changes and password-sharing crackdowns.

-

Maximizing ARPU: The hybrid model allows platforms to capture revenue from two sources: the subscription fee and the advertising revenue. For many platforms, the combined ARPU of an ad-tier subscriber is now competitive with, or sometimes exceeds, that of a premium subscriber.

B. The Two-Tiered Subscriber System

This shift is creating a deliberate divide in the user experience:

-

Premium Tier: Offers the highest quality (4K, HDR), maximum simultaneous streams, and the ad-free experience, becoming a privilege for those willing to pay a high price.

-

Basic/Ad Tier: Offers a reduced price in exchange for commercial interruptions and, often, a downgrade in features like resolution (HD only) or download options.

This divergence means the promise of equal, simple access to content is disappearing, replacing it with a complex, tiered system reminiscent of traditional cable TV packages. This strategic market shift is comparable to the technological and economic considerations involved in adopting new enterprise architectures. For a related discussion on making complex technology decisions based on cost and architecture, see our analysis on: Serverless Architecture vs. Containerization (Kubernetes): A TCO Analysis for AI Workloads.

4. Future Outlook: The Balancing Act

The future of streaming will be defined by the industry’s ability to balance revenue maximization with consumer satisfaction.

-

Advertising Innovation: To prevent ad fatigue, platforms must leverage user data and Connected TV (CTV) capabilities to offer highly personalized, less intrusive, and interactive ad experiences that improve the viewer’s experience rather than disrupt it.

-

The Consumer Backlash: As costs rise and the experience degrades (due to ads and feature restrictions), consumer frustration is rising. This is leading to higher churn rates and, concerningly, a minor resurgence in content piracy.

The winning platforms will be those that manage to consolidate their offerings, master the execution of their ad-supported tiers, and maintain a consistent flow of genuinely indispensable exclusive content, making their service a non-negotiable part of the entertainment budget.

REALUSESCORE Analysis Scores

Analysis of the driving forces and consumer challenges in the streaming video market:

| Evaluation Metric | Content Investment Scale | Profitability Potential (Hybrid) | Consumer Subscription Fatigue | Risk of Industry Consolidation |

| Industry Driver | 9.8 | 9.7 | 9.5 | 9.0 |

| Market Stability (Current) | 7.0 | 7.5 | 6.0 | 6.5 |

| REALUSESCORE FINAL SCORE | 9.6 | 9.5 | 6.5 | 7.0 |