The End of Passwords: Authentication Moves to Identity and Platform Control

The global mobile payments landscape in 2026 is witnessing a profound revolution driven by security innovation. Transactions are faster, more frequent, and increasingly borderless, elevating the stakes for authentication. The era of simple PINs and passwords is giving way to robust Biometric Security layered within comprehensive Digital Wallets, all governed by rapidly evolving international Regulation.

This analysis explores the three pillars defining the future of mobile payment security. We examine the shift to biometric modalities (Fingerprint, Face ID, Vein Mapping), the strategic importance of tokenization within major digital wallet platforms, and how geopolitical regulations like the EU’s PSD2 are forcing global standardization and stricter consumer authentication rules.

1. Biometrics: Authentication Based on Identity

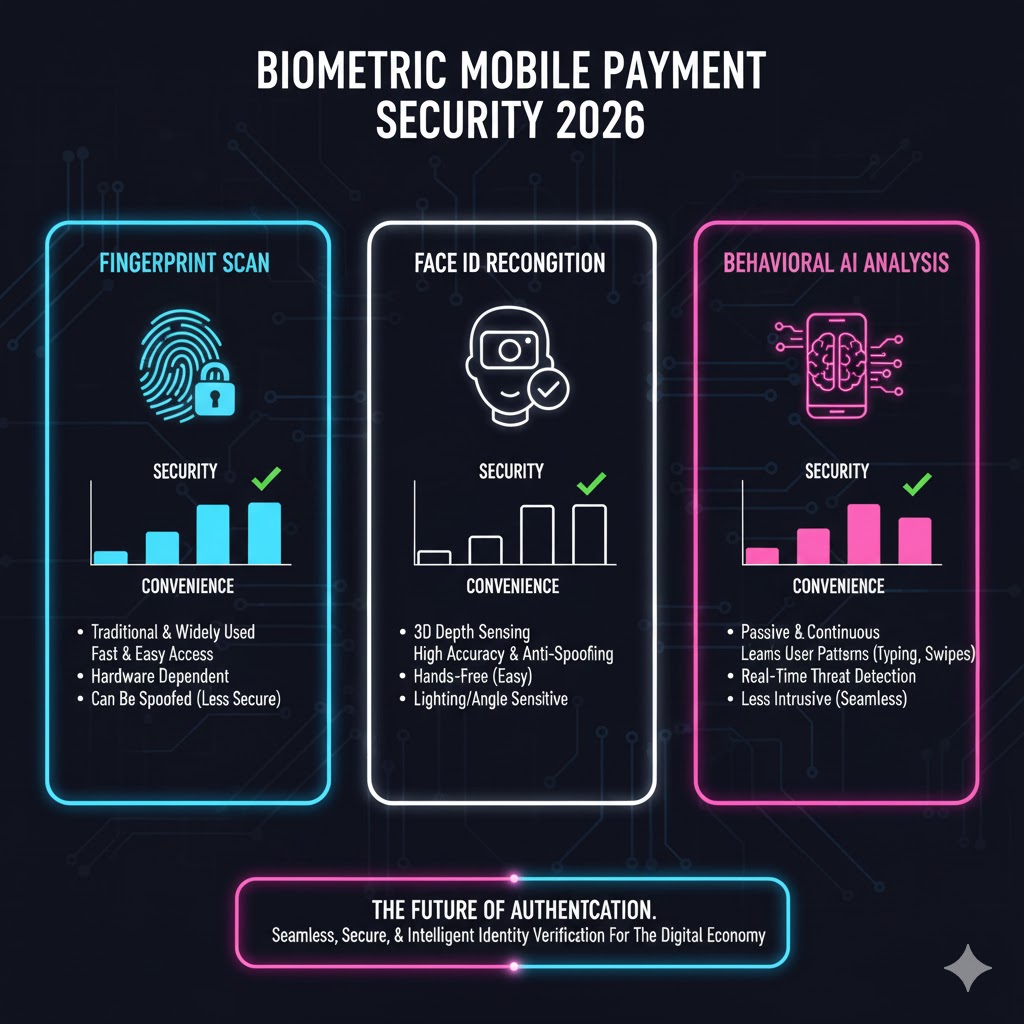

Biometrics offer a superior user experience and, critically, a lower fraud risk than legacy passwords. The 2026 market is characterized by multi-modal biometric adoption.

1.1 The Dominance of Passive Biometrics

Passive biometrics—authentication that happens seamlessly without explicit user action—is becoming the industry standard.

-

Facial Recognition (Face ID/Android Biometrics): Highly popular for its ease of use. Security relies on depth-sensing technology to prevent spoofing. However, reliability can be challenged by environmental factors (e.g., masks, extreme angles), pushing providers toward secondary factors.

-

Fingerprint (In-Display Sensors): Remains a fast, reliable secondary or primary factor, especially in environments where device handling is difficult. The move to larger, ultrasonic sensors has dramatically improved speed and accuracy.

1.2 Multi-Factor Authentication (MFA) Evolution

For high-value transactions, the industry is moving beyond simple single-factor authentication (SFA) to dynamic, risk-based MFA. This often combines a knowledge factor (PIN or pattern) with a biometric factor. The integration of advanced behavioral biometrics—analyzing typing speed, swipe patterns, and device handling—adds a subtle, persistent layer of security, providing defense against sophisticated social engineering and malware. This complex, multi-layered defense is essential against modern cyber threats. For a detailed look at advanced defense mechanisms, see our analysis: AI and Data Security: The New Frontier of Cyber Threats and Defense Mechanisms (LLM Focus)

2. Digital Wallets and Tokenization: Platform Security

Digital wallets (Apple Pay, Google Pay, Samsung Wallet) are not just apps; they are secure platforms built on cryptographic tokenization.

2.1 The Tokenization Standard

Tokenization is the core security mechanism that separates the digital wallet from the actual credit or debit card.

-

Mechanism: When a user registers a card, the card number (Primary Account Number or PAN) is replaced by a unique, randomized token. This token is useless if intercepted outside the secure environment.

-

Security Advantage: When a payment is made, only the token is transferred to the merchant. If the merchant’s system is breached, no actual card numbers are exposed. This decentralized security model has been crucial in reducing card-present fraud.

2.2 The Platform Battle and Ecosystem Security

Major technology companies treat their digital wallets as a strategic, secure gateway to their entire ecosystem. Security is a key competitive advantage. For instance, the tightly controlled environment of Apple’s Secure Element (SE) hardware chip provides a high barrier to entry for malware, setting a gold standard for hardware-level security. The ongoing battle for control over these user platforms directly affects security policies and implementation. The strategy of controlling the device and software ecosystem is paramount in modern tech competition. The Hardware Ecosystem War: Apple, Google, and Samsung’s Strategy for AI Device Integration

3. Global Regulatory Landscape: PSD2 and Standardization

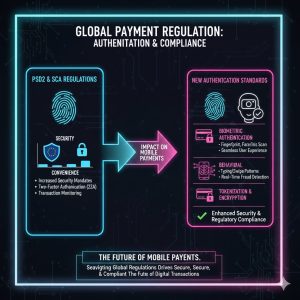

Regulatory intervention is forcing payment providers worldwide to raise security standards and streamline cross-border authentication processes.

3.1 PSD2 and Strong Customer Authentication (SCA)

The European Union’s Revised Payment Services Directive (PSD2) is arguably the most impactful piece of regulation shaping global mobile payment security.

-

Mandate: PSD2 mandates Strong Customer Authentication (SCA) for most electronic payments, requiring at least two independent factors from the categories of knowledge (e.g., PIN), possession (e.g., phone), and inherence (e.g., biometric).

-

Impact: This regulatory mandate forced payment providers and digital wallets globally to adopt more sophisticated, frictionless MFA. While PSD2 applies directly to the EU, its standards have effectively become the de-facto baseline for secure digital payments globally, driving international standardization.

3.2 Balancing Security, Privacy, and Usability

While regulation boosts security, it must be balanced against user experience (usability) and data privacy (GDPR). Overly complex authentication methods lead to cart abandonment. Therefore, the challenge for platforms is delivering SCA through passive, biometric means that meet the “independent factors” test without adding friction. Regulatory bodies worldwide are grappling with similar challenges in emerging tech fields. For more context on how regulation is shaping technology, refer to: The Regulation of Generative AI (US/EU): New Laws and Their Impact on Content Creation Platforms

4. Final Verdict: Security as the Competitive Edge

In 2026, security is no longer a feature but a foundation for the mobile payment experience. The winning platforms will be those that integrate seamless biometrics and robust, tokenized security while successfully navigating global regulatory requirements. The trend is clear: continuous, hardware-based authentication is replacing one-time passwords, making the digital wallet the single most important secure gateway to the consumer economy.

REALUSESCORE.COM Analysis Scores

| Evaluation Metric | Biometrics Implementation | Digital Wallet Security (Tokenization) | Regulatory Compliance |

| Security Effectiveness | 9.2 | 9.5 | 8.8 |

| User Experience (Frictionless) | 9.0 | 9.0 | 7.5 |

| Global Standardization | 8.0 | 9.5 | 9.8 |

| REALUSESCORE.COM FINAL SCORE | 8.7 / 10 | 9.3 / 10 | 8.7 / 10 |