Beyond Hype: Assessing Quantum’s Near-Term Commercial Viability (2026-2030)

Quantum computing is often touted as the next technological singularity—a paradigm shift capable of breaking current encryption, revolutionizing drug discovery, and optimizing global logistics networks. However, the reality of the Quantum Computing Market in 2026 is one defined by immense scientific progress alongside practical engineering challenges.

This analysis provides a critical reality check on the quantum landscape, separating scientific achievement from commercial viability. We evaluate the realistic Timeline for achieving fault-tolerant quantum computers (FTQC), track the patterns of massive Investment from both government and private sectors, and assess the current state of Enterprise Adoption—focusing on the niche applications where quantum advantage is already within reach.

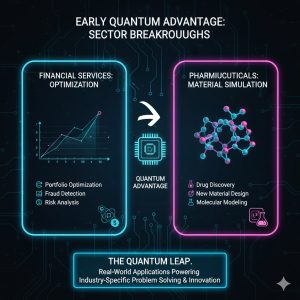

1. The Timeline Reality: NISQ vs. Fault-Tolerant Quantum Computing (FTQC)

The quantum industry operates in two distinct eras, and confusing them leads to misleading commercial forecasts.

1.1 The Noisy Intermediate-Scale Quantum (NISQ) Era (Current)

Currently, we are firmly in the NISQ era. NISQ machines (like those offered by IBM, Google, and IonQ) have between 50 and 1,000 physical qubits.

-

Characteristics: These qubits are highly sensitive to environmental noise (decoherence), leading to errors. They lack the error-correction necessary for sustained, complex calculations.

-

Commercial Use: NISQ systems are suitable primarily for research and algorithm development. Enterprises are using them for basic proof-of-concept tasks, such as simple material simulation or exploring quantum machine learning (QML) kernels, but they cannot yet deliver true quantum advantage over classical supercomputers for large, real-world problems.

1.2 The Fault-Tolerant Quantum Computing (FTQC) Era (Post-2030 Outlook)

The transition to the FTQC era—the true point of commercial revolution—requires massive hardware scaling and sophisticated error correction, where thousands of physical qubits are used to create just one reliable logical qubit.

-

Realistic Timeline: Industry consensus suggests that the first practical FTQC capable of breaking AES encryption (requiring roughly 20 million physical qubits) will likely emerge between 2035 and 2045. Near-term (2026-2030) progress will focus on reaching the 1,000+ logical qubit milestone, which will still be largely confined to early strategic applications in materials science and finance.

-

Engineering Challenge: The complexity of scaling and maintaining the quantum state of these systems presents a challenge comparable to the early days of semiconductor manufacturing. The continuous progress in scaling microprocessors is a crucial backdrop to quantum development. Global Semiconductor Foundry Landscape: TSMC, Samsung, and Intel’s 2nm Node Strategy Update

2. Global Investment and Strategic Positioning

Quantum technology has become a geopolitical imperative, driving enormous public and private investment.

2.1 Government Funding: The Race for Quantum Supremacy

Governments view quantum computing as a critical strategic asset, similar to nuclear technology or space exploration in past decades.

-

United States: Programs like the National Quantum Initiative (NQI) have channeled billions into national labs and academic centers (e.g., Caltech, MIT). The focus is on long-term hardware and algorithm development, particularly superconducting and trapped-ion systems.

-

China: China’s quantum investment is believed to rival or exceed that of the U.S., with a strong centralized focus on both communications (quantum cryptography) and computing hardware, aiming for technological self-sufficiency.

-

Europe: The Quantum Flagship initiative has cemented EU countries, particularly Germany and the Netherlands, as leaders in certain quantum software and foundational physics research.

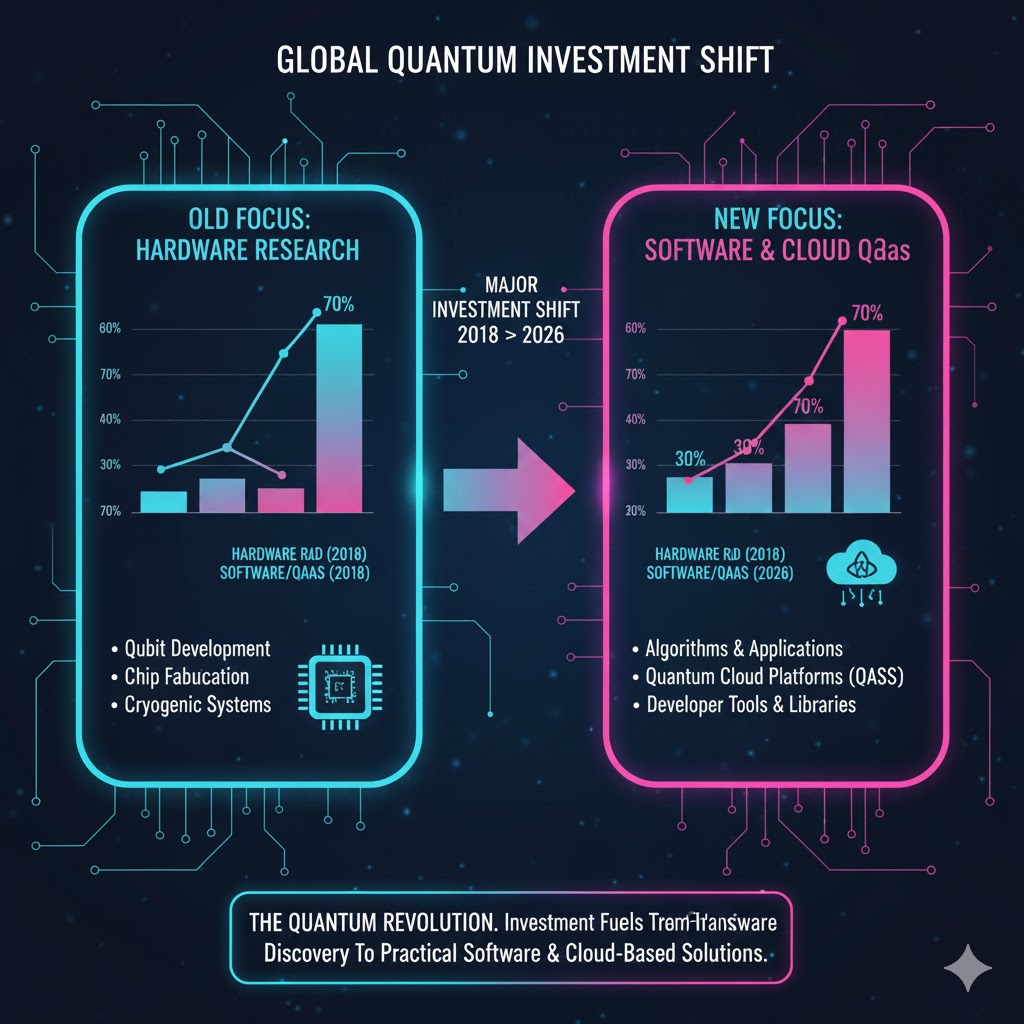

2.2 Private Sector Investment: Shifting Focus from Hardware to Software

Venture Capital (VC) investment initially poured into hardware startups (IonQ, Rigetti). However, the market is now experiencing a shift.

-

Software and Algorithms: The current bottleneck is the lack of quantum-ready software engineers and domain-specific quantum algorithms. Investment is rapidly moving towards quantum software platforms, compilers, and specialized programming languages that allow enterprises to prepare for the quantum era using classical systems.

-

QaaS (Quantum-as-a-Service): Cloud providers (IBM, Microsoft Azure, Amazon Braket) are leading the charge, democratizing access to various quantum hardware modalities via the cloud. This strategy minimizes the enterprise’s upfront capital expenditure and accelerates research.

3. Enterprise Adoption: Focus on Quantum Advantage Niche

Few companies are currently experiencing “Quantum Advantage”—the point where a quantum computer outperforms the best classical solution. However, strategic adoption is accelerating in highly specific domains.

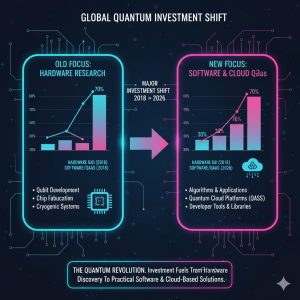

3.1 Financial Services (Optimization)

Quantum’s potential lies in its ability to solve complex optimization problems that current Monte Carlo simulations struggle with.

-

Portfolio Optimization: Firms are experimenting with NISQ algorithms to optimize asset allocation across thousands of variables, aiming for fractional improvements in risk management and return profiles.

-

Fraud Detection: Quantum machine learning models are being explored for faster, more sophisticated pattern recognition in high-frequency trading and anti-fraud systems.

3.2 Materials Science and Pharmaceuticals (Simulation)

This is arguably the most promising near-term application. The behavior of molecules is fundamentally quantum mechanical, making quantum computers the ideal tool for accurate simulation.

-

Drug Discovery: Simulating the ground state energy and electron configuration of complex molecules to design new catalysts or pharmaceutical compounds is a key focus. This could dramatically shorten the decade-long timeline for bringing a new drug to market.

-

Chemical Engineering: Developing more efficient solar cells, batteries, and fertilizer production methods through accurate material simulation.

3.3 The Workforce Imperative

The greatest barrier to enterprise adoption is not the hardware itself, but the lack of skilled talent proficient in quantum mechanics, computer science, and complex domain knowledge. Organizations are increasingly investing in upskilling and reskilling programs to ensure their current workforce is ready for the quantum shift. The challenge of adapting the workforce mirrors previous technological shifts, such as the introduction of widespread AI automation. AI and the Future of Work: A Comprehensive Guide to Digital Labor, Automation, and Reskilling

4. Market Reality Check: Quantum Hype vs. Quantum Value

While the long-term potential of quantum computing is undeniable, the immediate market reality requires patience and focused investment.

The majority of enterprise IT spending on “quantum” today is actually Quantum Readiness spending—allocating resources for algorithm development, upskilling employees, and exploring hybrid classical/quantum workflows. The true commercial market for FTQC remains highly illiquid until fault-tolerance is achieved. Investors should remain cautious of overly optimistic timelines while acknowledging the deep strategic value of the technology. Quantum is an essential research expenditure, not a current ROI-driven IT investment.

REALUSESCORE.COM Analysis Scores

| Evaluation Metric | Score (Out of 10.0) | Note/Rationale |

| Current Performance (NISQ) | 5.5 | Limited practical advantage; best for research and small-scale proofs-of-concept. |

| Investment Confidence | 9.0 | High, driven by geopolitical strategy and long-term scientific necessity (Govt/VC funding robust). |

| Enterprise Adoption Viability (2026-2030) | 6.5 | Niche, high-value applications (Finance, Chemistry) showing promise, but generalized adoption is low. |

| Fault Tolerance (FTQC) Timeline | 4.0 | Realistically beyond 2035 for true commercial impact (e.g., breaking encryption). |

| REALUSESCORE.COM FINAL SCORE | 6.2 / 10 | Strategic long-term bet with massive potential, but high current risk and deferred commercial viability. |