The Streaming Wars of Gaming: Access vs. Ownership

For our audience of high-value American consumers, the question facing the gaming industry is less about which console to buy and more about how they access their content.1 Microsoft’s Game Pass Model has fundamentally disrupted the traditional console business, shifting the focus from hardware sales to recurring revenue and a massive digital library.2 While Game Pass provides undeniable value, its future dominance is complex, facing challenges from profitability concerns, price hikes, and intense competition from Sony’s PlayStation Plus. This analysis evaluates whether the subscription-first approach is truly the future of gaming subscriptions that will ultimately dominate the console market.

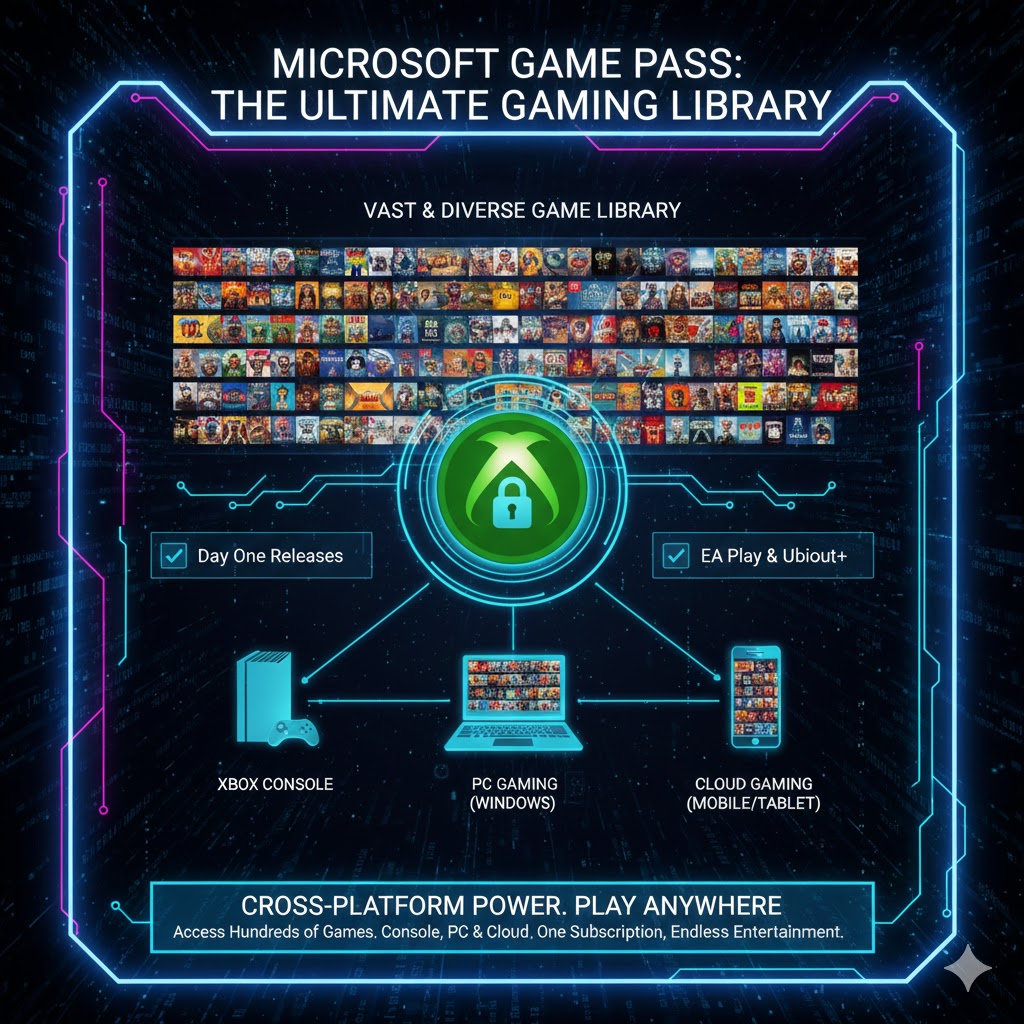

Architectural Deep Dive: The Game Pass Value Proposition

Microsoft’s strategy is built on a simple, yet powerful, premise: maximize content access across multiple platforms for a predictable monthly fee.

1. Day-One First-Party Access

The single most compelling feature of Microsoft’s Game Pass Model is the inclusion of all first-party Xbox Studio titles (like Call of Duty and Starfield) on the day of their release. This eliminates the need for a $70-80 upfront purchase for major titles, a value proposition that directly appeals to budget-conscious and value-driven consumers. This commitment, however, has an undeniable cannibalizing effect, reportedly causing some titles to lose up to 80% of their premium sales on the Xbox platform 1.4.3

2. The Cloud and Cross-Platform Strategy

Game Pass Ultimate includes Xbox Cloud Gaming, which allows subscribers to stream a growing library of titles on PCs, tablets, smart TVs, and mobile devices 2.2.4 This strategy effectively decouples the Xbox experience from the physical console, expanding the Total Addressable Market (TAM) beyond traditional console ownership.5 Cloud gaming hours have reportedly seen significant year-over-year growth (up 45% in 2025) 4.1, indicating that this accessibility is critical to subscriber engagement.6

The Competition: PlayStation Plus’s Different Approach

Sony’s PlayStation Plus, while also a tiered subscription service, employs a significantly different strategy that seeks to maximize profitability through high-margin sales and hardware dominance.

Quality vs. Quantity and Timing

The core difference lies in content timing. PlayStation Plus focuses on offering a vast library of high-quality, high-rated games, including its legacy classics and major first-party blockbusters—but typically not on day one 2.2.7 Sony relies on players purchasing highly anticipated titles upfront at full retail price, before the games cycle into the subscription library months or years later. This strategy prioritizes the immediate profitability of premium, high-margin software sales.

Console Ecosystem Lock-in

While Microsoft is pursuing a multiplatform, cloud-centric future, PlayStation Plus remains heavily tethered to the PlayStation console ecosystem, with less robust support for PC and minimal mobile cloud streaming compared to Game Pass 2.2. Sony is prioritizing console loyalty, which is reflected in their stronger console market share and higher physical software sales figures 1.3.

Future-Proofing and Financial Viability

The ultimate dominance of Microsoft’s Game Pass Model will depend less on subscriber numbers and more on long-term financial stability and market adaptation.

Profitability and Price Hikes

Despite significant revenue (forecasted to reach $5.5 billion in 2025) 4.4, the escalating cost of acquiring and licensing major titles (especially after the Activision-Blizzard acquisition) has led to multiple Game Pass price increases in 2025 1.2, 4.3. This necessity to raise prices challenges the service’s core “value” proposition and risks alienating the mass audience that initially fueled its rapid growth. Increasing the Average Revenue Per User (ARPU) is now a central financial strategy 4.3.

Market Saturation and Slowing Growth

While Game Pass subscriber numbers continue to grow (estimated at 35-37 million in mid-2025), the pace of growth has slowed compared to earlier years 4.4.8 The global gaming subscription market as a whole is growing (reaching $14.3 billion in 2025) 3.1, but in developed markets, saturation is a risk. 9Future growth will rely on expanding cloud accessibility in emerging, mobile-first markets like India and Brazil 4.1.

Final Verdict: The Dominance of Access, Not Necessarily The Console

Microsoft’s Game Pass Model represents the future of gaming subscriptions because it successfully shifted the value metric from owning a console to accessing a library. However, its dominance will likely be defined by the “service” and the cloud, rather than the console market itself.

-

Console Market: Game Pass is a fantastic value driver, but it is currently not dominating the console market, where PlayStation maintains strong hardware and physical sales superiority 1.3.10

-

Subscription Market: Game Pass dominates the type of subscription—day-one access—that forces rivals like PlayStation to continually re-evaluate their value proposition.11

The real success of Game Pass is transforming Xbox into a multi-platform service brand, ensuring its future-proofing beyond the life cycle of any single console generation.

| Evaluation Metric | Score (Out of 10.0) | Note/Rationale |

| Value Proposition (Day-One Access) | 9.7 | Unmatched access to first-party titles, setting the standard for the industry. |

| Multi-Platform & Cloud Accessibility | 9.5 | Ultimate tier is the industry leader in cross-platform (PC, Mobile, Console) play via the cloud. |

| Console Market Dominance | 7.0 | Strong service, but Microsoft’s console hardware sales and market share lag behind the competition. |

| Financial Viability & Profitability | 7.5 | Significant revenue and growth, but constrained by high content acquisition costs leading to price hikes. |

| Future-Proofing (Decoupling Hardware) | 9.3 | The strategy ensures the brand’s relevance regardless of console sales performance. |

| REALUSESCORE.COM FINAL SCORE | 8.6 / 10 | Weighted score reflecting high service value but lower console market control. |